The Big Story

Record highs and lows in the housing market

Quick Take:

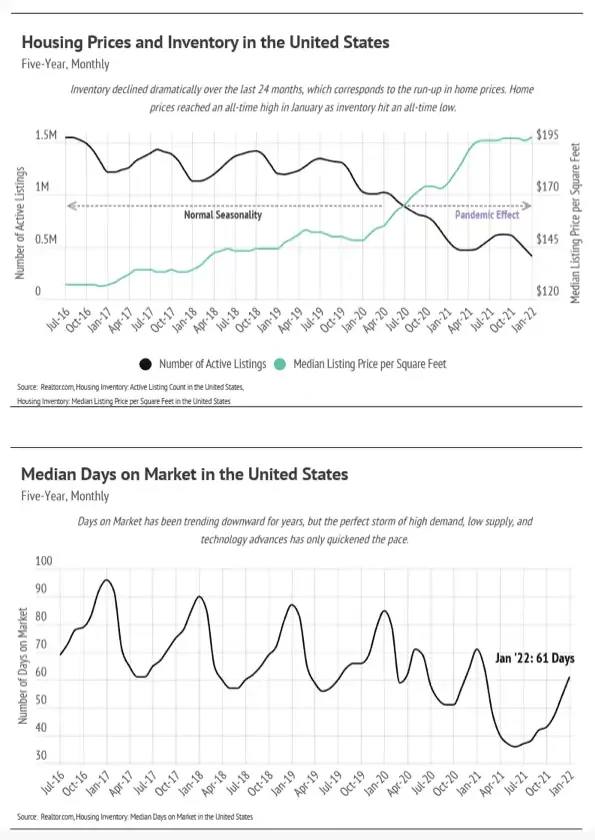

- Home prices in the United States hit a record high, while housing inventory declined to a record low.

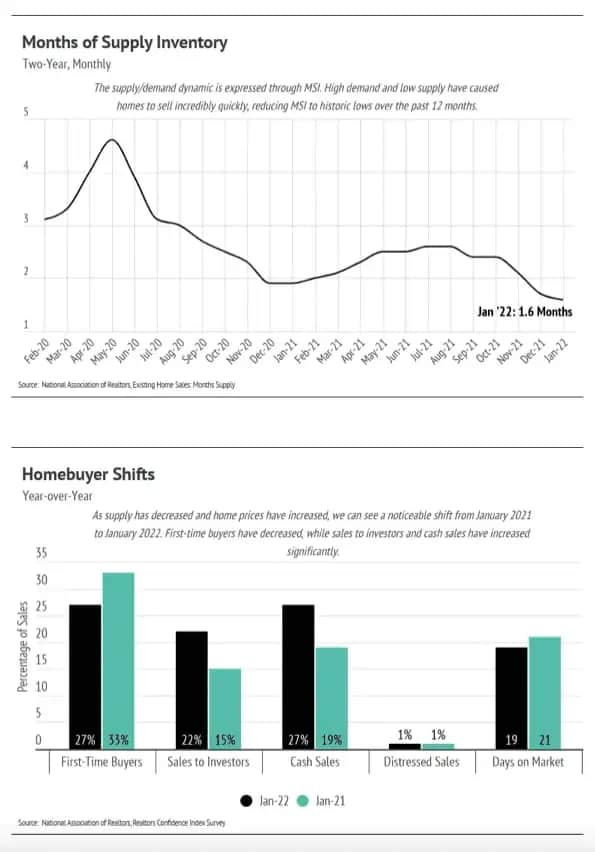

- Homes are selling extremely quickly, and the high demand and low supply have dropped the Months of Supply Inventory to its lowest level in history.

- Rising prices and low supply have shifted who’s buying homes.

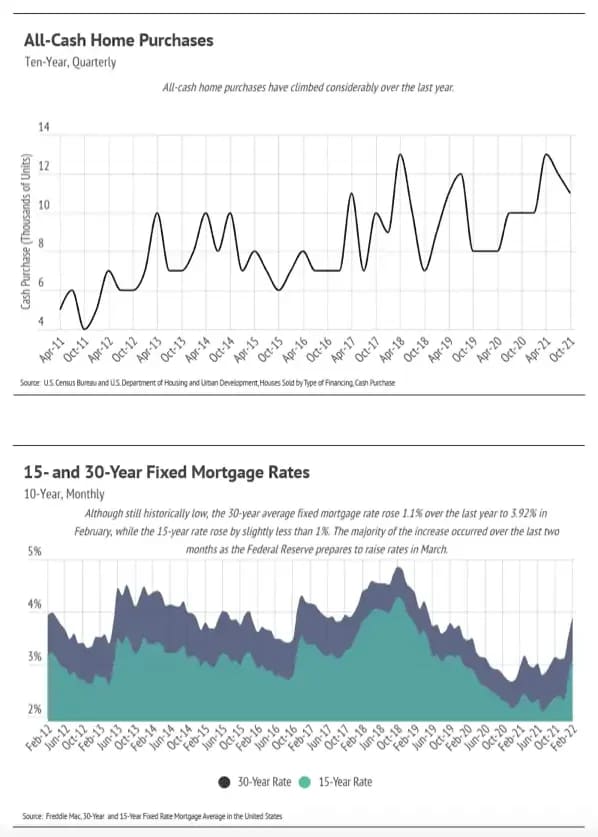

- The average 30-year fixed mortgage rate rose over 1% in the past year, mostly during the past two months. Economists expect the Federal Reserve (the Fed) to start raising rates in mid-March, the first of six 0.25% increases throughout the year.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

Amplified seasonal trends

Seasonality in the housing market was incredibly steady before the pandemic. Prices typically rose from January to June, when inventory was low but rising, and then flattened from July to December, when inventory was high but declining. In January 2020, homes were already undersupplied, hitting a record low with just over a million homes for sale on the market. When the pandemic hit, demand for homes exploded, dropping inventory to shockingly low levels. During the 18 months between January 2020 and June 2021, inventory declined 49% and prices increased 32%, doubling the total price increase of the previous three years combined. By January 2022, inventory had reached an all-time low, down 60% in the past two years, while home prices reached a record high, up 34%.

Home sales have only gotten quicker as the market has become more efficient. We can see this trend through the Days on Market and Months of Supply Inventory (MSI). Before the pandemic, homes were already selling more quickly, primarily because of technology and an increasingly competitive market. A more efficient market matches the right people with the right home at a fast pace, causing a drop in supply when new homes aren’t being built. MSI, which quantifies the supply-and-demand relationship, is at a record low, further indicating a sellers’ market. The low supply, high prices, and speed of purchases have shifted homebuyer makeup.

The number of first-time buyers dropped 6% over the past year, while sales to investors rose 7%. All-cash offers increased significantly, often disproportionately affecting first-time buyers, who are most likely to need financing. With rising mortgage rates, many first-time buyers will once again be hit hardest with higher monthly payments. Rates have already risen, because the Fed is expected to start increasing rates in mid-March, and they will only climb higher. Because of the rising cost, the average age of homebuyers is climbing. The average first-time buyer is now 33 years old, and the average repeat buyer is 56 years old, an all-time high. As we enter a new chapter in the housing market, one characterized by rising rates and very low supply, demand can only go one direction: down. But for now, prices aren’t in danger of declining.

Over the next several months, we expect supply to matter more than the interest rate hikes when it comes to home prices. Economists anticipate that the Fed will start the first of six incremental 0.25% increases in March. The Fed uses interest rates in particular as a tool to meet its dual mandate of maximum employment and price stability. With inflation at a near-40-year high, prices for most goods are rising while incomes are not. This situation gives the Fed little choice but to raise interest rates. Essentially, when the cost to borrow increases, fewer people want to borrow, leading to less consumer spending (less demand), which lowers prices.

As we enter this new chapter of rising mortgage rates, we don’t expect home prices to decline significantly, if at all, because supply is still such a driving factor. The low supply means that demand can decline without negatively impacting prices. We don’t expect home prices to appreciate at the record level we experienced over the past two years, but we do expect to see an increase. We are still in the middle of one of the strongest sellers’ markets in history. Buyers must come in with fast, competitive offers in this environment.

Big Story Data

The Local Lowdown

Quick Take:

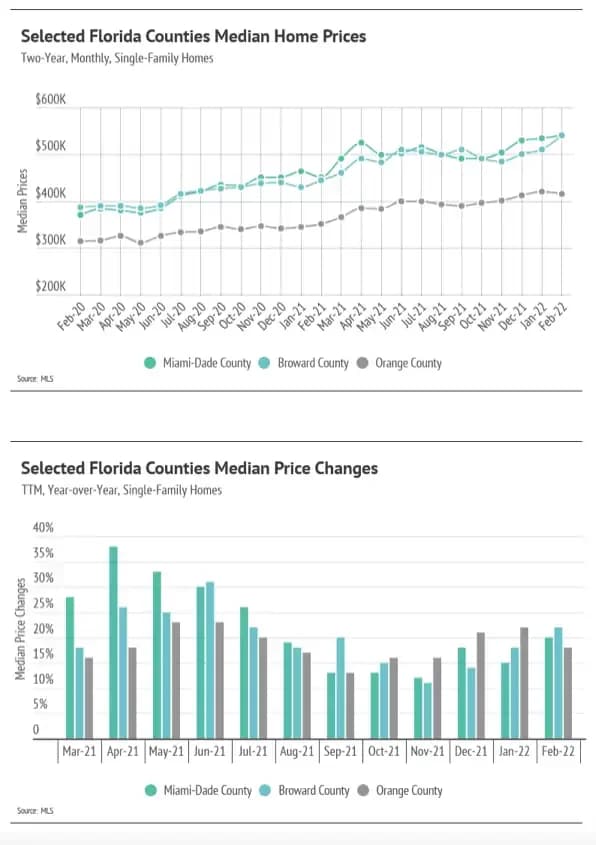

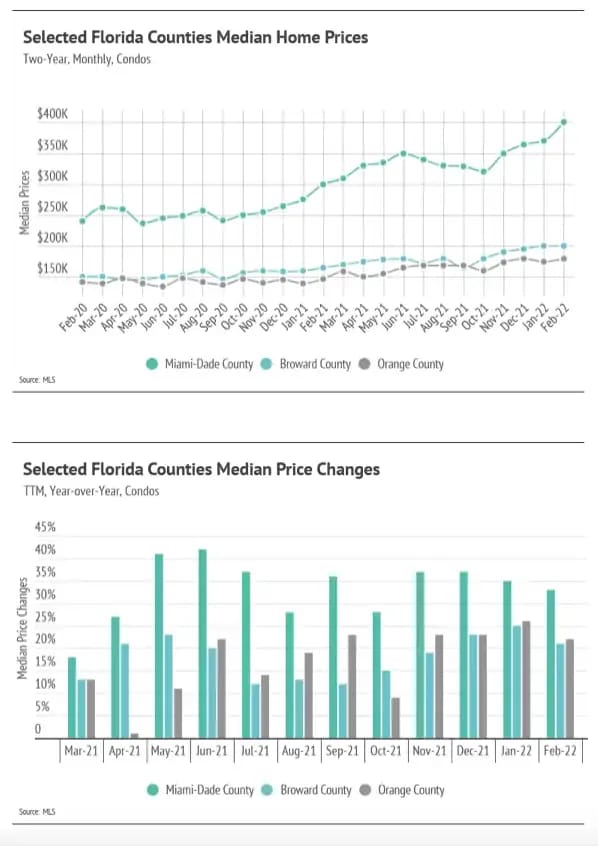

- Home prices increased dramatically over the past year across selected Florida markets, reaching record highs across counties with the exception of Orange County single-family homes:

- Miami-Dade County: +20% for single-family homes; +33% for condos

- Broward County: +22% for single-family homes; +21% for condos

- Orange County: +18% for single-family homes; +22% for condos

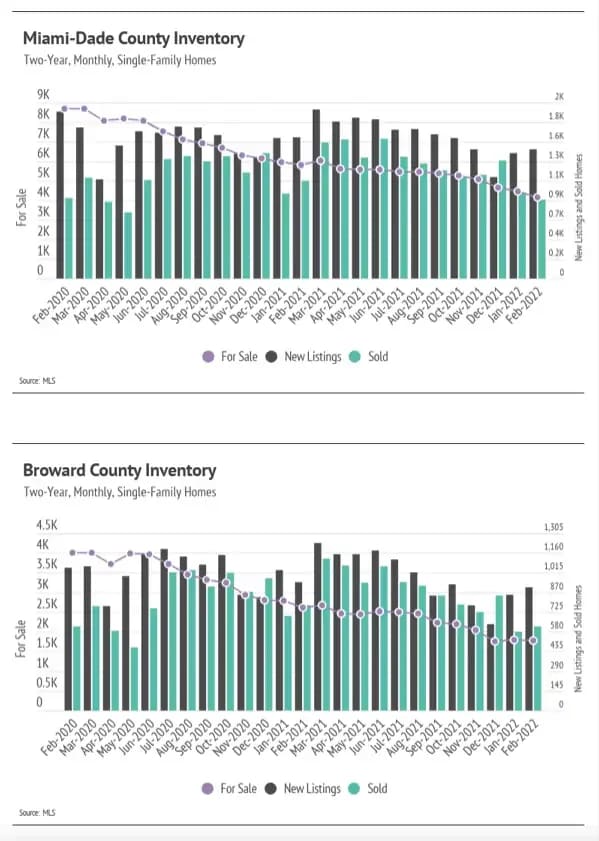

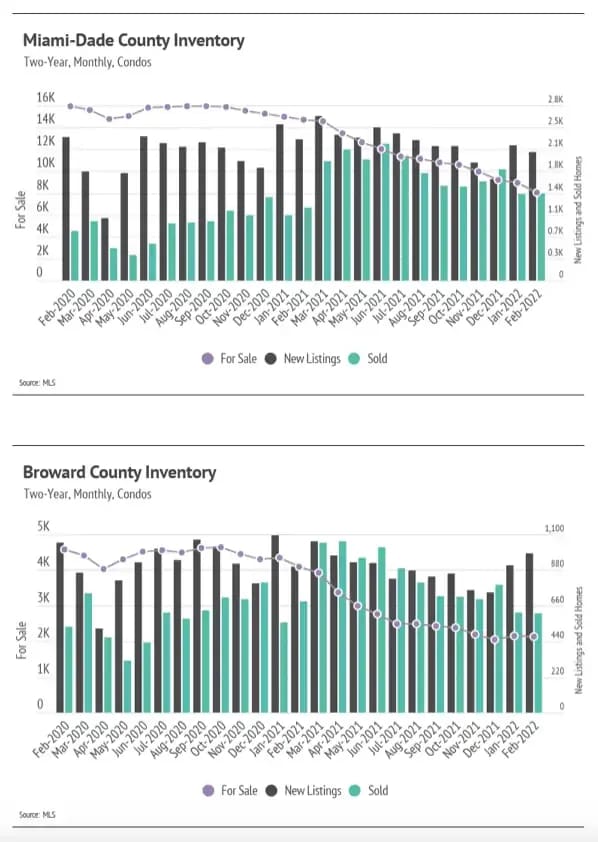

- Home sales remained elevated despite historically low inventory, which reflects the high demand in Florida.

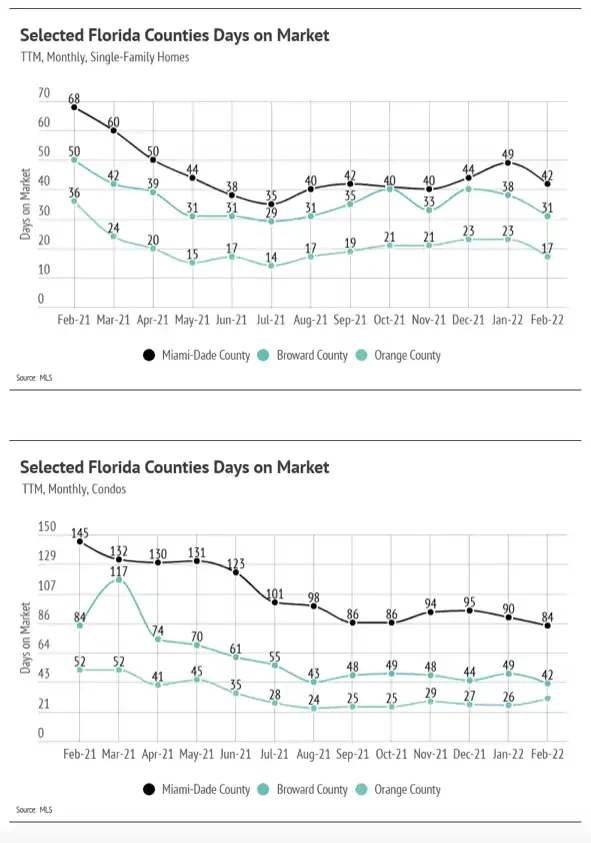

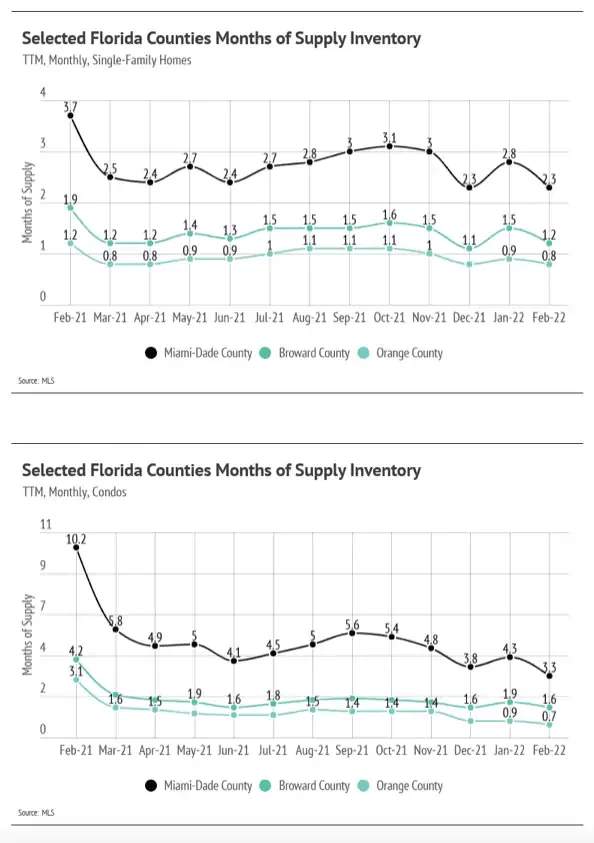

- Months of Supply Inventory further indicates a sellers’ market. Homes are selling quickly as buyers compete over the limited inventory.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Home prices hit record highs in front of Fed rate hikes

Single-family home and condo prices rose to all-time highs across Florida counties in February 2022 with the exception of Orange County single-family homes, which declined from the January peak. Mortgage rate hikes really only lower demand in the long-term; in the short-term, demand increases as buyers try to lock in a lower rate. The housing market in Florida has a major advantage in that people simply want to live there. Despite the huge increases in home prices over the past 18 months, Florida’s lack of housing supply will keep prices rising in the year to come.

The Fed is expected to raise interest rates by 0.25% six times this year, going from 0% to 1.50%. We are now entering a period where factors that affect prices are more mixed, unlike the past two years when all the factors caused prices to increase. Rising interest rates, which will hopefully curb the still-rising inflation, will make homes less affordable and dampen demand over the course of the year. But inventory is so low that even with less demand, the market will likely be undersupplied. It might seem counterintuitive that home prices can still appreciate after increasing so much over the past two years, but with inventory at record lows, home prices in 2022 will still increase — though at a slower rate than in 2021. With high sales relative to the available inventory, we anticipate a competitive market in the year ahead.

Record-low inventory across Florida

Florida, like the rest of the country, has a historically low housing inventory. The sustained high demand and lack of new listings over the past year brought single-family home and condo supplies to record lows across markets. We are seeing that far more people want to live in Florida than want to leave. Sales have been incredibly high, especially when accounting for available supply, again highlighting demand in the area. Sellers can expect multiple offers, and buyers should come with competitive offers. The incredibly high demand we’ve seen over the past year might wane as interest rates increase; however, the supply is so low that the market can handle a drop in demand without negatively affecting prices. The 30-year average fixed rate mortgage hasn’t climbed above 4% yet, but it almost certainly will as the Fed starts raising rates. If mortgage rates reach 5%, demand will likely decline more substantially. In the next few months, demand will remain high relative to available supply.

Months of Supply Inventory further indicates high demand and low supply

Homes are still selling extremely quickly. Days on Market declined in February, which further highlights demand, as homes typically take longer to sell in the winter.

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes for sale on the market to sell at the current rate of sales. The average MSI is four to five months in Florida, which indicates a balanced market. An MSI lower than that indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). Currently, single-family home and condo MSIs are historically low, indicating a strong sellers’ market.

Local Lowdown Data